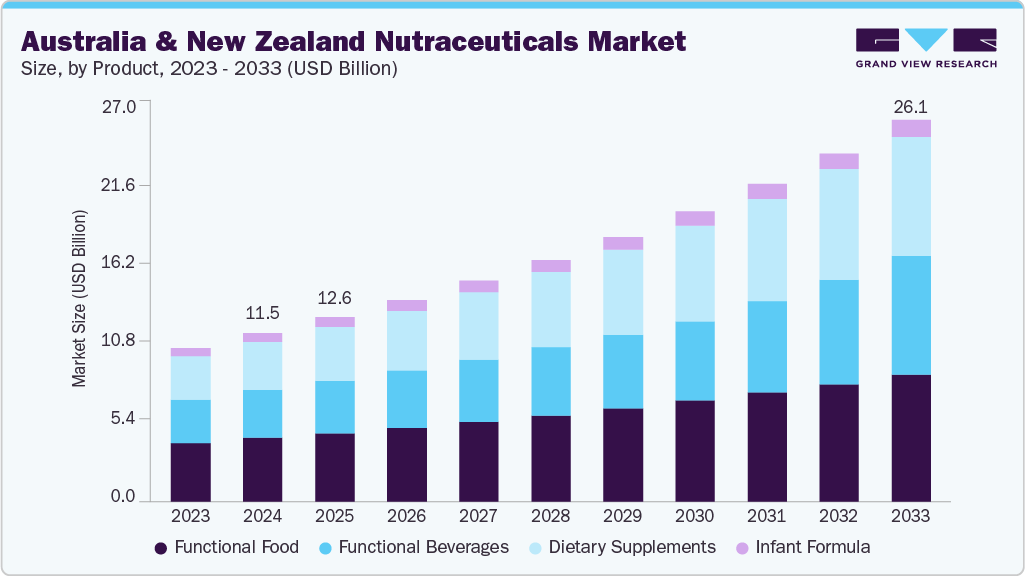

The Australia & New Zealand nutraceuticals market size was estimated at USD 11.51 billion in 2024 and is projected to reach USD 26.10 billion by 2033, growing at a CAGR of 9.5% from 2025 to 2033. The market’s growth is primarily driven by rising consumer awareness of preventive healthcare and the recognized connection between diet and overall well-being.

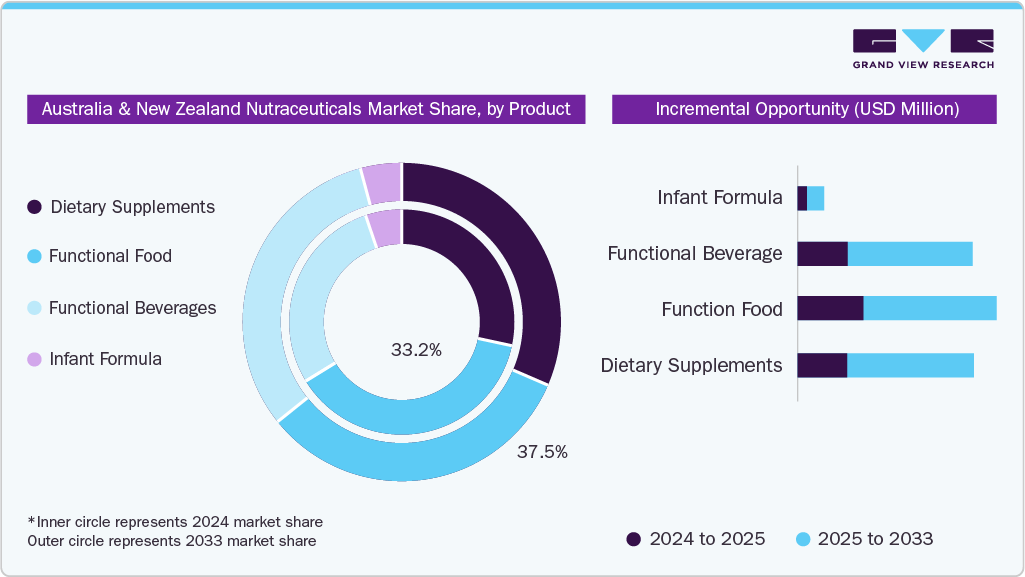

- By product, the functional food segment held the highest market share of 37.6% in 2024.

- Based on application, the weight management & satiety segment held the highest market share in 2024.

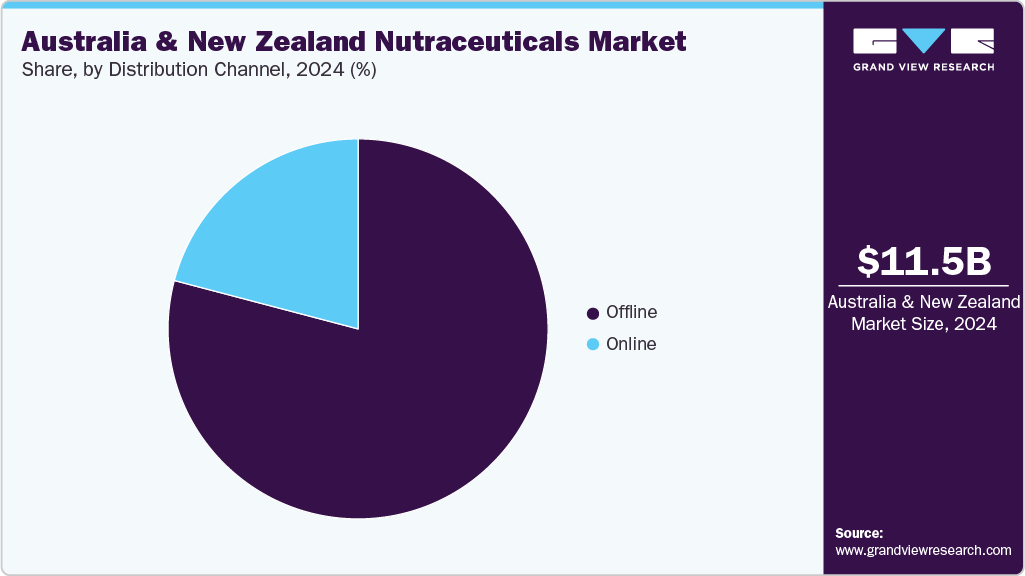

- By distribution channel, the offline segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 11.51 Billion

- 2033 Projected Market Size: USD 26.10 Billion

- CAGR (2025-2033): 9.5%

The growing prevalence of chronic diseases such as obesity and diabetes is encouraging individuals to embrace healthier lifestyles, including the regular use of nutraceutical products. This shift toward proactive health management represents a critical trend propelling the continued growth of the nutraceutical industry.

A growing aversion to synthetic additives and a demand for transparency are fueling interest in nutraceuticals derived from natural sources, such as fruits, vegetables, herbs, and botanicals. Advances in extraction and processing technologies also contribute significantly, allowing manufacturers to deliver more potent and bioavailable formulations using these natural ingredients.

These trends are being reinforced by advancements in diagnostic tools and personalized health-monitoring technologies, enabling consumers to make more informed choices regarding their health and supplement use. The accessibility and convenience of nutraceuticals are also playing a vital role in market expansion. The rise of e-commerce platforms has simplified the process of researching and purchasing products. At the same time, the availability of user-friendly formats such as gummies, powders, and ready-to-drink options has broadened consumer appeal.

Consumer Insights

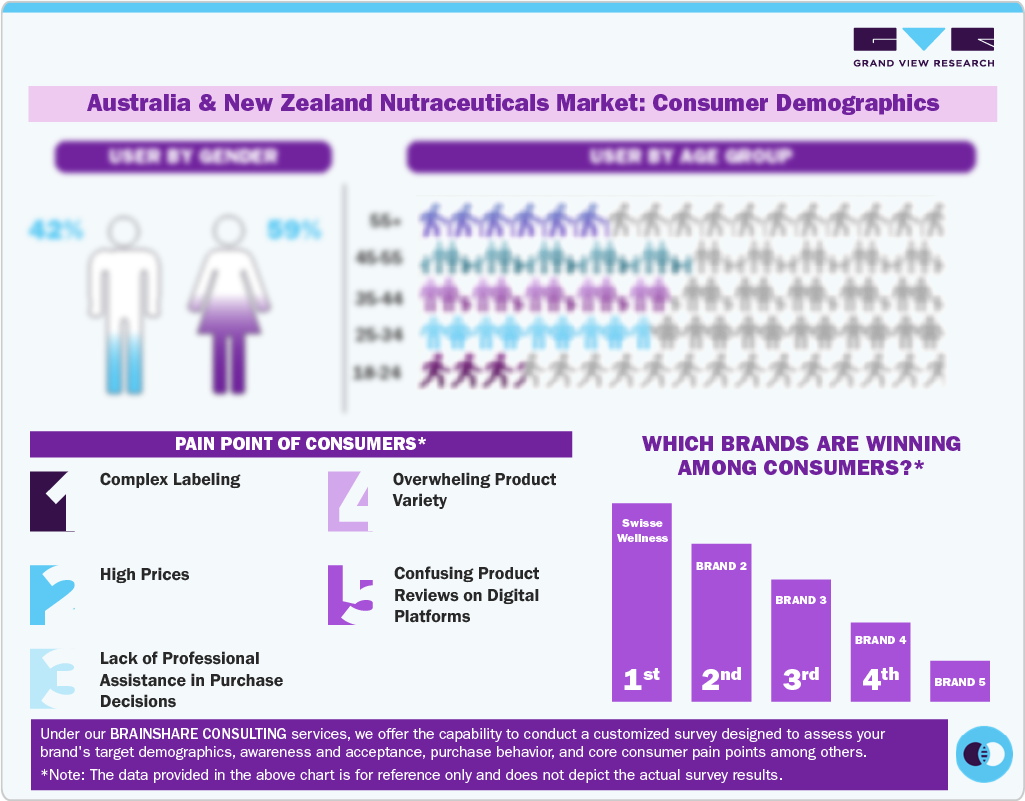

Consumers across Australia and New Zealand are increasingly making conscious decisions to adopt healthier lifestyles, driven by a growing awareness of the connection between nutrition, preventive health, and long-term well-being.

Many individuals opt for clean-label and plant-based products, viewing them as safer, more natural alternatives that support energy, immunity, mental clarity, and overall vitality. The increasing visibility of health information through digital platforms, influencers, and wellness communities has further empowered consumers to make informed, intentional choices.

Product Insights

Based on product, the functional food segment dominated the market, accounting for a 37.6% revenue share in 2024, driven by an increasing consumer focus on preventive healthcare and wellness. Individuals in Australia and New Zealand are becoming more proactive in managing their health through daily nutrition, turning to functional foods to address nutritional gaps and support long-term well-being. This trend is particularly strong among the aging population, who seek fortified foods to support bone, heart, and cognitive health.

The functional beverage segment is projected to experience the fastest CAGR of 10.8% from 2025 to 2033. Fueled by a notable consumer shift toward healthier and more convenient alternatives to conventional sugary drinks. A prominent trend driving this growth is the increasing demand for natural, “better-for-you” options, which has led to a surge in the popularity of beverages fortified with essential vitamins, minerals, antioxidants, and plant-based ingredients. The rise of fitness culture and active lifestyles is also a key growth driver, with consumers gravitating toward sports and performance drinks containing electrolytes, protein, and BCAAs to support hydration, recovery, and endurance.

Application Insights

The weight management & satiety segment held the largest revenue share of the Australia & New Zealand nutraceuticals market in 2024. Consumers are seeking sustainable, science-backed alternatives to traditional dieting. Among the most promising strategies is the adoption of controlled energy intake combined with moderately elevated protein consumption, which has been shown to enhance satiety, increase thermogenesis, and support the maintenance of lean body mass.

The convenience of ready-to-drink shakes, nutrition bars, and powdered supplements is also a key driver, enabling easy integration into fast-paced lifestyles. In Australia, where the average prevalence of overweight individuals is 16.9% and obesity levels continue to rise, more people are turning to nutraceutical supplements to complement their diets and daily nutritional needs.

The energy and endurance segment is projected to experience growth from 2025 to 2033. The rising demand for energy and endurance supplements is driven by increasing consumer focus on maintaining physical performance, combating fatigue, and supporting active lifestyles. In Australia and New Zealand, growing participation in fitness activities, sports, and high-intensity training routines has increased interest in nutraceuticals that enhance stamina, improve recovery, and boost overall energy levels. Consumers are increasingly seeking scientifically formulated products that provide sustained energy without the adverse effects associated with synthetic stimulants.

Distribution Channel Insights

The offline distribution segment dominated the Australia and New Zealand nutraceuticals market in 2024. The offline channel remains a vital component of the nutraceutical market across Australia and New Zealand, encompassing pharmacies, supermarkets, specialty health stores, and physical retail outlets. Consumers continue to value the in-store experience, particularly the ability to physically inspect products, access expert guidance, and receive immediate service. Pharmacies, in particular, are trusted retail environments for nutraceutical purchases due to their strong association with health and wellness. Similarly, supermarkets and specialty health stores offer broad accessibility, brand visibility, and product discovery opportunities among casual and committed health consumers.

The online segment is anticipated to experience the fastest CAGR from 2025 to 2033. Driven by changing consumer purchasing behaviors, particularly among younger demographics. There is a growing preference for purchasing dietary supplements, functional foods, and wellness products such as snack bars, protein powders, and vitamins through digital platforms. Key motivations include convenience, access to a wider product selection, competitive pricing, and availability of detailed product and ingredient information.

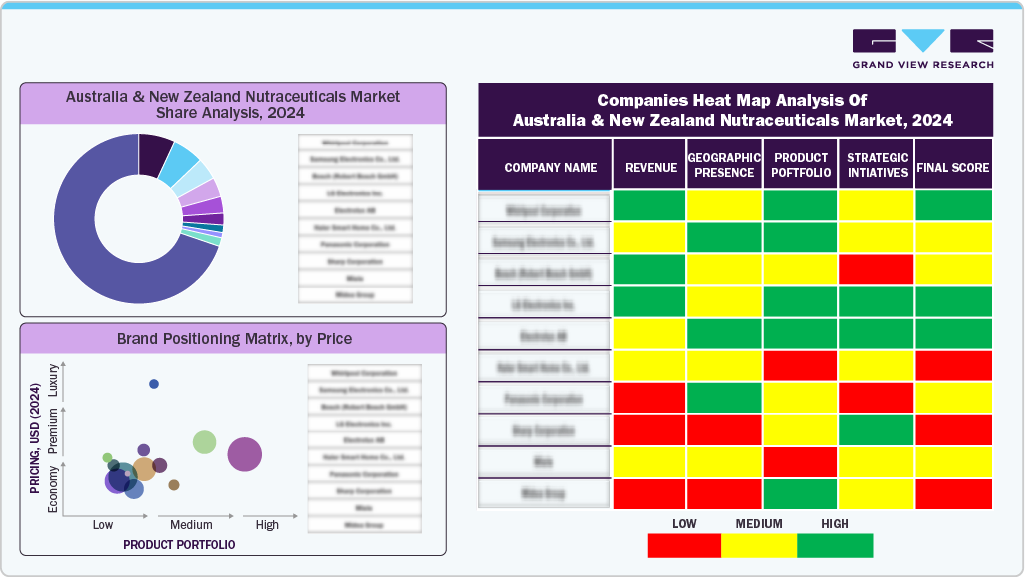

Key Australia & New Zealand Nutraceuticals Company Insights

Some of the key players in the Australia & New Zealand nutraceuticals market include Swisse Wellness Pty Ltd, BLACKMORES, Herbalife International of America, Inc., Amway & others.

-

Swisse Wellness offers a comprehensive portfolio of nutraceutical products tailored to support diverse health needs, including immune health, energy and vitality, sleep support, bone and joint health, cognitive function, etc.

- Amway

- Swisse Wellness Pty Ltd

- BLACKMORES

- Herbalife International of America, Inc.

Australia & New Zealand Nutraceuticals Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 12.61 billion

Revenue forecast in 2033

USD 26.10 billion

Growth rate

CAGR of 9.5% from 2025 to 2033

Actual data

2021 – 2024

Forecast period

2025 – 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, application, distribution channel

Key companies profiled

Amway, Swisse Wellness Pty Ltd, BLACKMORES, Herbalife International of America, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Australia & New Zealand Nutraceuticals Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Australia & New Zealand nutraceuticals market report based on product, application, and distribution channel:

-

Product Outlook (Revenue, USD Million, 2021 – 2033)

-

Dietary Supplements

-

Tablets

-

Capsules

-

Soft Gels

-

Powders

-

Gummies

-

Liquid

-

Others

-

-

Functional Food

-

Functional Beverages

-

Energy drink

-

Sports drink

-

Others (Functional dairy based beverages, kombucha, kefir, probiotic drinks, and functional water)

-

-

Infant Formula

-

-

Application Outlook (Revenue, USD Million, 2021 – 2033)

-

Distribution Channel Outlook (Revenue, USD Million, 2021 – 2033)