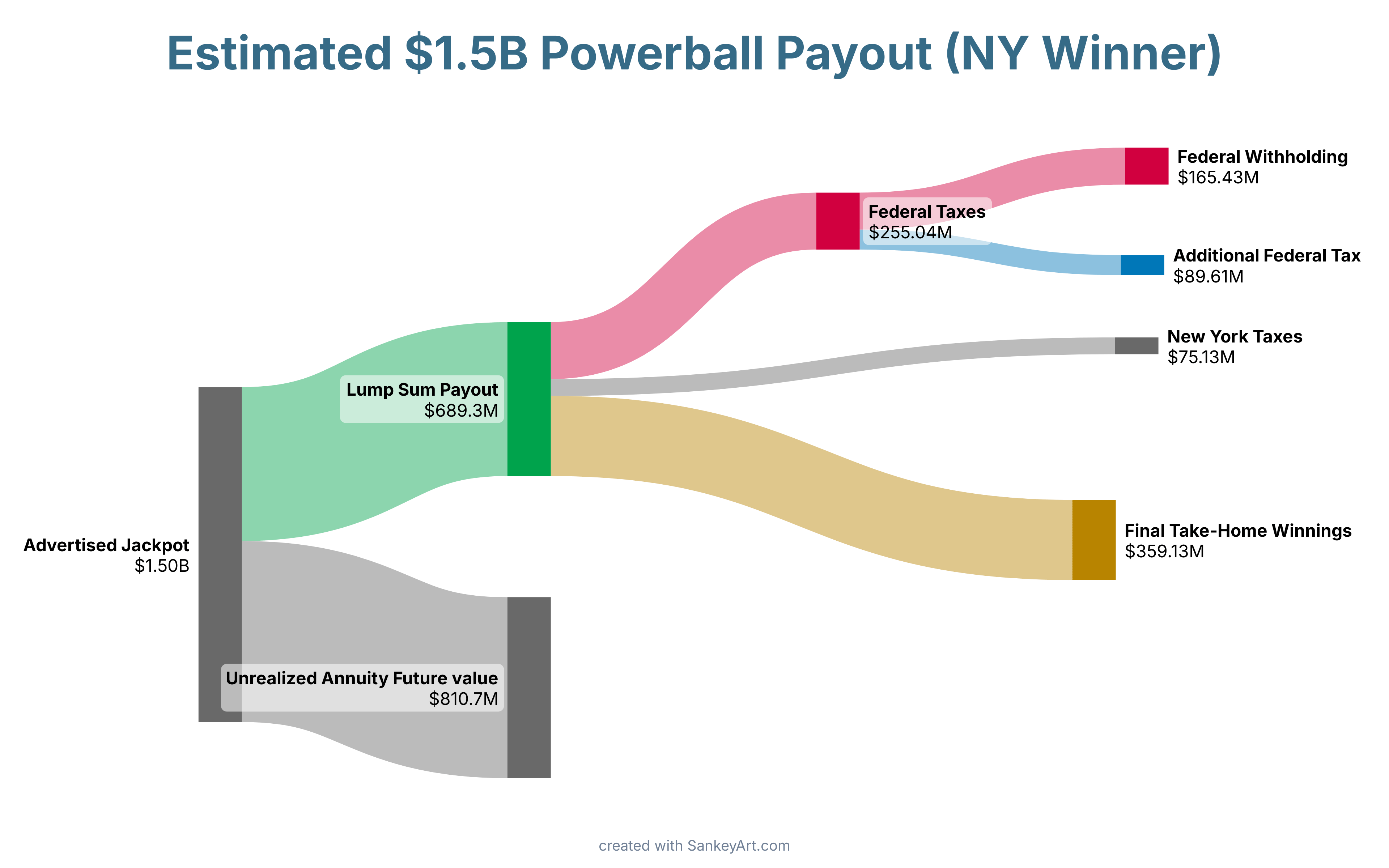

Based on the figures from this Forbes article, adjusted to the $1.5B jackpot for Saturday.

I chose New York state since NY has the highest lottery state tax at 10.9%, some states like California and Florida do not tax lottery winnings at all.

The 10.9% is only if the winner is from Upstate NY:

- If in NYC, you'd pay an additional $26.71 million in local taxes

- If in Yonkers, you'd pay an additional $10.18 million in local taxes

Assumed the highest marginal tax rate of 37%

Visualization tool: sankeyart.com

Posted by GoForthandProsper1

![[OC] Estimated payout if the $1.50B Powerball Winner is from New York State [OC] Estimated payout if the $1.50B Powerball Winner is from New York State](https://www.byteseu.com/wp-content/uploads/2025/12/v27pkg2t978g1-1536x960.png)

28 Comments

What the hell am I supposed to do with a measly $359M??

Interesting. I had no idea that the jackpot value included unrealized gains. Makes since why the total payout is much lower.

What’s unrealized annuity future value?

That won’t even pay for a Ballroom!

If you invest 300m at 5.5% you would get about 5x after 30 years, so 1.5B while still having 59.13 million to live of.

Do you really mean future value of the annuity, or PDV?

Seem strange to have the lump sum be real, today dollars but the annuity be some ‘future’ value.

I’ve bought these tickets, but as a Canadian taxpayer I don’t think any of those taxes would apply. They would be collected but eligible to be reclaimed. And Canada does not tax lottery winnings. It’s an interesting situation. I’m sure Trump would have a field day with that one.

Lump sum after all taxes, if invested conservatively, gives about $24 million per year in returns, or at least $12M after taxes, so you could have a disposable income of $1M per month, forever.

I can understand the lump sum being part of income tax, but, I feel like the annuity option should fall under capital gains. I know it isn’t, but the way its structured, and being backed by Strips, it should be considered a capital gain, as it reasonably functions similar to the lump sum being reinvested into T notes. I think its very foolish to take the annuity. The future is uncertain. Imagine there’s a war in the next 30 years and the top rate goes up 95%, or some jackal embezzles money from the lottery, and causes it to go bust, or we have a few consecutive years of inflations sitting 8% yoy. Why take the risk?

If you disregard the coupon taxes, and just take the 359M after taxes for a lump with a bond rate YTW >4.625%, you’re sitting at ~1.3 at the end of 30 years, and you’re paying capital taxes to your uncle only, as states do not take tax on T bills, vs letting them do it and ending ~782M after state taxes are taken into account. If that’s the risk free rate, even an extremely mild risk, will easily over yield what they would pay you at above 4.625%. Plus, if you are sitting bond deep at a good rate, even a few basis point decline in the offer yield will greatly increase your face value if you do choose to unload the bond, and take the risk in another market. Also, controlling your bonds gives you the option to basis trade them through the ZB, and snag a nice safe arb against the contango of futures delivery, allowing you to easily yield above your coupon rate at a relatively predictable and low risk manner. You could easily outperform the annuity without ever having to engage with the risk of the equity market ever again.

[obligatory “you won the lottery – congrats, yall are fucked” link ](https://www.reddit.com/r/AskReddit/s/iE2NdMobgP)

Can I get this value expressed in Solid Gold Toilets? Asking for a friend.

Taxes were included in the Lump Sum, but not the Annuity. Should probably be consistent in both sides.

Annuity should show the yearly amount you receive before taxes. Then the taxes you would pay (federal and state). Then the take home amount after taxes each year. In order to be consistent with the Lump Sum section.

It’s crazy to me that lottery winnings are taxable in the US.

EDIT: lol why am I being downvoted? Taxing income is one thing, taxing a one of gift is robbery.

I mean, its STILL $300+ mil.

But also funny when you realize winning the lottery means you pay more in taxes than most billionaires pay in multiple decades.

Should be net present value of the annuity to compare, or else you need to use a future value of the lump sum as well.

They should advertise both the Cash & Annuity options.

Half of the lottery ticket sale goes to the state (funds education where I’m from) and should be exempt from State taxes.

Federal Taxes are ridiculous on these too. It’s pooled money, not income.

Surprising that whoever did this doesn’t know that the payout if you don’t take the lump sum isn’t static. Whatever is left after each annual payout is invested and managed by the New York State pension fund, which historically does very well. Last time the jackpot was this big there was an article in the NYT about how foolish it is to take the lump sum and surrender do much money

Crazy lottery winners get taxed at the maximum bracket while billionaires pay 10% capital gain taxes when they sell their fucking stocks. LMAO

The USA mega website breaks this down for all states.

So it’s not impossible to tax billionaires, it’s optional (except for ordinary people)

My estimated (MA) payout is 355,710,000. So we agree.

They tax lottery winnings more than billionaires 😂 THIS is what the take-home amount should look like for billionaires that make $1.5B

If only the government taxed millionaires & billionaires that much…

If Mark Cuban tells me to take the annuity, I’m taking the annuity.

I ran some numbers, but there are a whole lot of caveats. Keeping it “simple,” if I started with $360 million, spending about 3% annually ($10.8 million at the start), assuming the highest tax bracket, and an average ROI (5-10%), after 30 years, I’d have about $750 million left over after spending between $324-$470 million.

Which definitely DOES not suck.

So you start by taking 800 million less before taxes come into play.

It’s funny people hyper fixate on the ~300M lost to taxes and completely ignore the ~800M lost to taking the lump sum.

Other billionaires don’t have to pay taxes though…. Seems unfair.