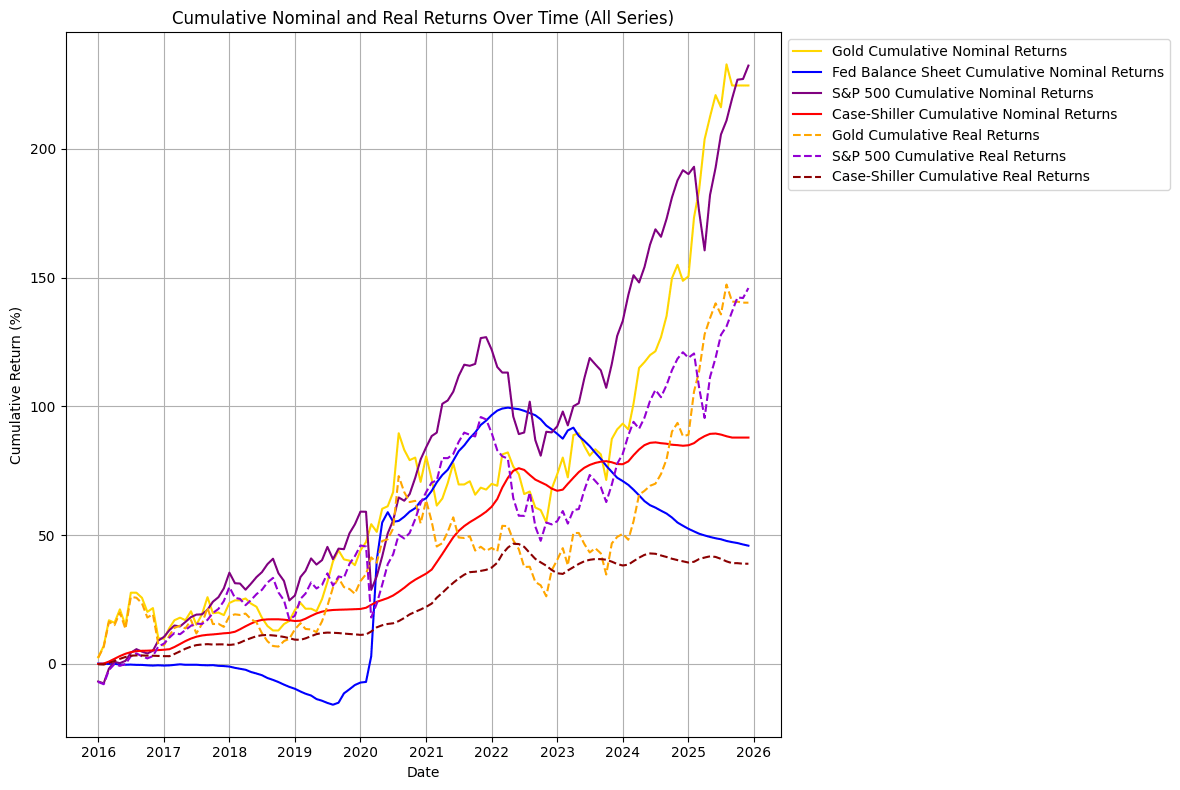

Just ran some analysis and this was one image I thought you all may be interested in…

Individual Series Trends

- Gold Price Index: Showed a general upward trend over the period, with notable periods of significant increases, especially during times of economic uncertainty, but also experienced corrections.

- Federal Reserve Balance Sheet: Exhibited substantial growth, particularly after the 2020 crisis, indicating expansionary monetary policy. More recently, it showed periods of stagnation or slight decline, suggesting a shift towards quantitative tightening or slower growth.

- CPI (Inflation): Maintained a relatively stable, upward trajectory for most of the period, with a more pronounced acceleration in recent years (post-2020), indicating higher inflationary pressures.

- US 10-Year Treasury Yield: Showed significant fluctuations, with a general decline in the earlier part of the period followed by a notable rise and recent stabilization, reflecting changes in monetary policy expectations and economic conditions.

- S&P 500: Demonstrated strong long-term growth with significant rallies and corrections, reflecting overall stock market performance and economic cycles.

Case-Shiller Home Price Index: Showed a consistent and strong upward trend, particularly accelerating post-2020, indicating a robust housing market.

"(Source) All data are from FRED:

– gold by using the data on FRED for "Import Price Index (End Use): Nonmonetary Gold (IR14270)", located at (https://fred.stlouisfed.org/series/IR14270).

– Fed ballance sheet, "Assets: Total Assets: Total Assets (Less Eliminations from Consolidation): Wednesday Level (WALCL)", located at (https://fred.stlouisfed.org/series/WALCL)

– inflation using Consumer Price Index: Consumer Price Index for All Urban Consumers: All Items Less Food and Energy in U.S. City Average (CPILFESL), located at (https://fred.stlouisfed.org/series/CPILFESL)

– S&P 500 (SP500), located at (https://fred.stlouisfed.org/series/SP500)

– S&P Cotality Case-Shiller U.S. National Home Price Index (CSUSHPINSA), located at (https://fred.stlouisfed.org/series/CSUSHPINSA)

– US 10 year treasury yield "Market Yield on U.S. Treasury Securities at 10-Year Constant Maturity, Quoted on an Investment Basis (DGS10)", located at (https://fred.stlouisfed.org/series/DGS10)

- The tool used to generate the visual (Tool):

Python via google collab notebooks."

Posted by ringdingjinglejangle

![Assets over the past decade controlling for inflation[OC] Assets over the past decade controlling for inflation[OC]](https://www.byteseu.com/wp-content/uploads/2025/12/65tgkc5m35ag1-1024x686.png)