Some crypto industry leaders are disappointed following reports that lawmakers might be open to the idea of banning stablecoin yields.

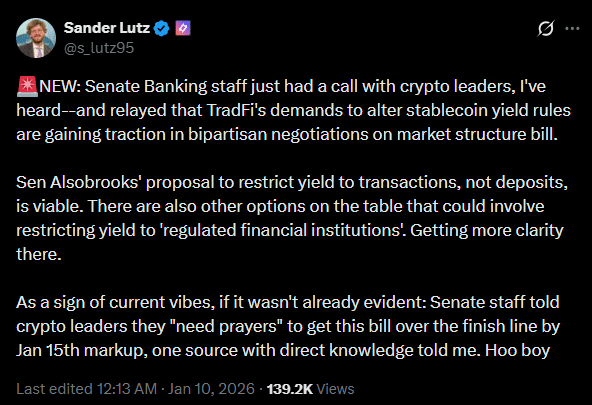

According to reporter Sander Lutz, lawmakers are now receptive to TradFi demands to change stablecoin yield rules during bipartisan negotiations on the crypto market structure bill. The bill is scheduled for a markup on 15 January.

Reacting to the development, Galaxy CEO Mike Novogratz slammed the legislators, calling the update a “sad state.”

“Sad state that Congress cares more about banks margins than they do consumers! Both D’s and R’s need to ask who are they serving?”

For his part, Nic Carter, partner at crypto VC firm Castle Island Ventures, said that the sector would be better off without the bill if stablecoin rewards are restricted.

“If they want to kill stablecoin yield we might as well just let the bill die.”

Bill Hughes, a lawyer at Consensys and one of the attendees at the meeting, acknowledged potential pitfalls. However, he remains optimistic about the crypto bill.

“For what it’s worth, I left the call more bullish than I had been previously. We are close. Pitfalls, for sure. But closer than we’ve ever been. And smart people calling the game. I’m optimistic.”

What to expect from crypto bill markup

Both the Senate Banking Committee and Senate Agriculture Committee are expected to markup their respective version of the crypto bill on 15 January. The Banking committee handles the SEC’s oversight mandate, while the Agriculture committee will cover the responsibility of the Commodity Futures Trading Commission (CFTC).

Although the bill is sponsored by Republicans, they must have Democrat buy-in to pass the committee vote before being advanced to the Senate chamber for a final floor vote.

For the Senate Banking group, the key contentious issues have been stablecoin yields, DeFi provisions, and ethics standards that seek to ban President Donald Trump’s family from the crypto sector.

Based on Carter and Novogratz’s reactions, it’s unclear whether yields or DeFi regulations will be deal-breakers.

However, according to Senator Tim Scott (R-SC), Senate Banking Committee chair, it may be time to take the bill to the next step after “good-faith, bipartisan negotiations.”

What’s next if the vote fails?

Alex Thorn, Galaxy Research’s Head of Research, recently reiterated that the bill needs 7-10 Democrats to pass the Senate Banking committee vote (A total of 60 YES votes needed to pass).

If the vote falters, it would have minimal impact. However, it will still sour market sentiment, he said. He also warned that another committee vote could be challenging in 2026.

“If the Senate falls short next week, the combination of crowded congressional calendars and looming midterm elections makes a second run in 2026 highly uncertain.”

Final Thoughts

- TradFi’s demand to restrict stablecoin yields is reportedly gaining traction in Congress.

- Failure to pass the committee vote on 15 January could throw the bill into limbo.